All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (life insurance for business owners through brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

They typically supply an amount of coverage for a lot less than permanent kinds of life insurance policy. Like any type of policy, term life insurance policy has benefits and drawbacks depending on what will certainly work best for you. The advantages of term life consist of affordability and the capacity to personalize your term length and insurance coverage amount based on your requirements.

Depending on the kind of plan, term life can use set premiums for the entire term or life insurance on level terms. The fatality benefits can be fixed.

Expert Term Life Insurance For Couples

You ought to consult your tax obligation advisors for your details factual situation. Rates mirror policies in the Preferred Plus Rate Class concerns by American General 5 Stars My agent was really educated and helpful at the same time. No stress to acquire and the procedure was fast. July 13, 2023 5 Stars I was satisfied that all my needs were satisfied immediately and properly by all the agents I talked to.

All paperwork was digitally finished with accessibility to downloading for personal data maintenance. June 19, 2023 The endorsements/testimonials offered need to not be understood as a suggestion to acquire, or an indicator of the worth of any type of services or product. The testimonies are real Corebridge Direct customers who are not connected with Corebridge Direct and were not provided settlement.

2 Expense of insurance policy rates are figured out making use of methods that vary by firm. It's vital to look at all aspects when evaluating the overall competition of prices and the worth of life insurance policy coverage.

Guaranteed What Is Decreasing Term Life Insurance

Absolutely nothing in these products is planned to be suggestions for a certain circumstance or person. Please seek advice from your very own advisors for such guidance. Like many group insurance coverage plans, insurance policy plans used by MetLife include specific exemptions, exceptions, waiting durations, reductions, limitations and terms for maintaining them active. Please call your advantages manager or MetLife for prices and full information.

Generally, there are 2 kinds of life insurance coverage plans - either term or long-term strategies or some combination of both. Life insurance firms use different types of term plans and standard life policies in addition to "interest sensitive" products which have come to be much more widespread since the 1980's.

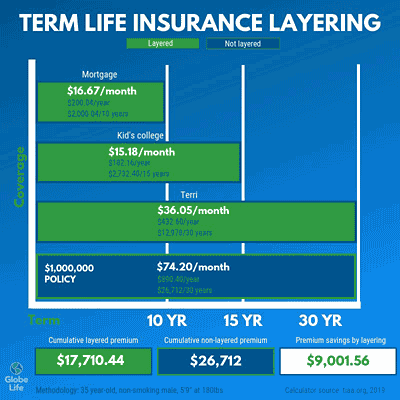

Term insurance policy supplies protection for a specified time period. This duration might be as brief as one year or supply insurance coverage for a certain variety of years such as 5, 10, 20 years or to a specified age such as 80 or in some cases up to the oldest age in the life insurance policy mortality tables.

Reputable Short Term Life Insurance

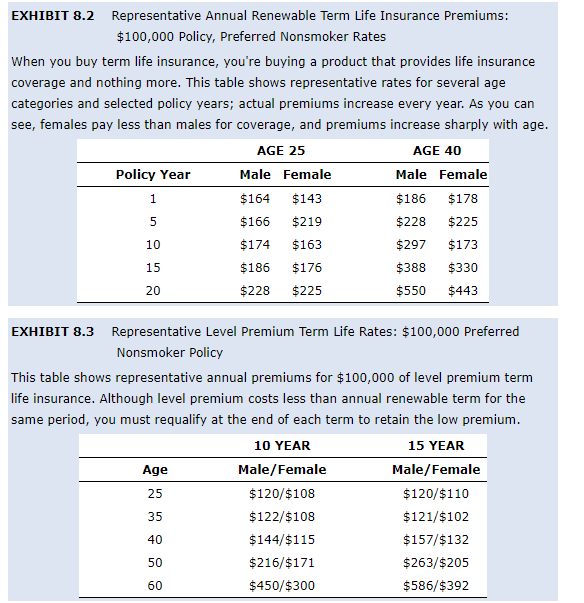

Currently term insurance coverage prices are really competitive and among the least expensive historically seasoned. It must be kept in mind that it is an extensively held belief that term insurance coverage is the least expensive pure life insurance policy coverage offered. One needs to evaluate the plan terms thoroughly to make a decision which term life choices are appropriate to satisfy your certain scenarios.

With each new term the premium is increased. The right to restore the plan without proof of insurability is an essential benefit to you. Or else, the threat you take is that your wellness might wear away and you may be not able to acquire a policy at the very same rates and even in any way, leaving you and your recipients without coverage.

The size of the conversion period will certainly vary depending on the kind of term plan purchased. The premium rate you pay on conversion is usually based on your "current achieved age", which is your age on the conversion date.

Under a degree term policy the face amount of the policy continues to be the exact same for the entire duration. With reducing term the face quantity reduces over the duration. The costs stays the very same each year. Usually such policies are offered as home mortgage defense with the quantity of insurance policy reducing as the balance of the home mortgage decreases.

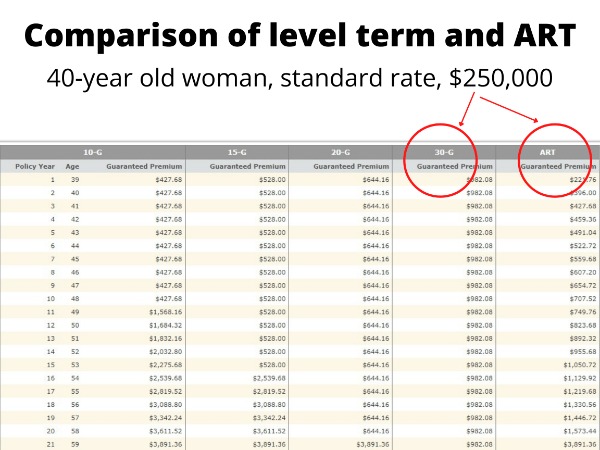

Commonly, insurers have actually not can alter premiums after the plan is marketed (a renewable term life insurance policy can be renewed). Because such policies may continue for years, insurance companies must use traditional death, passion and expenditure price estimates in the costs calculation. Adjustable costs insurance policy, nevertheless, enables insurance companies to offer insurance coverage at reduced "present" costs based upon less traditional presumptions with the right to transform these premiums in the future

Affordable Which Of These Is Not An Advantage Of Term Life Insurance

While term insurance policy is designed to supply security for a specified time duration, long-term insurance coverage is designed to supply protection for your whole life time. To maintain the premium price degree, the costs at the more youthful ages exceeds the real price of protection. This added costs constructs a book (cash value) which assists spend for the policy in later years as the price of defense rises above the costs.

Under some plans, costs are required to be paid for an established variety of years. Under various other plans, costs are paid throughout the insurance holder's life time. The insurer spends the excess costs bucks This kind of plan, which is in some cases called money value life insurance policy, produces a cost savings aspect. Money worths are critical to an irreversible life insurance policy plan.

Tailored A Term Life Insurance Policy Matures

Occasionally, there is no correlation between the dimension of the cash value and the premiums paid. It is the cash money value of the policy that can be accessed while the insurance policy holder lives. The Commissioners 1980 Criterion Ordinary Mortality Table (CSO) is the current table made use of in calculating minimum nonforfeiture worths and policy books for average life insurance policies.

There are two fundamental groups of irreversible insurance policy, typical and interest-sensitive, each with a number of variants. Conventional whole life plans are based upon long-term quotes of cost, interest and death (what is level term life insurance).

If these price quotes change in later years, the firm will certainly change the premium appropriately however never over the maximum ensured costs mentioned in the plan. An economatic whole life policy provides for a basic amount of taking part whole life insurance with an extra supplemental coverage given via using dividends.

Because the costs are paid over a much shorter period of time, the costs payments will certainly be greater than under the whole life strategy. Single premium entire life is restricted payment life where one huge premium payment is made. The plan is totally paid up and no more costs are required.

Table of Contents

Latest Posts

Best Funeral Plan For Over 50

Is Funeral Insurance Worth It

Seniors Funeral Plans

More

Latest Posts

Best Funeral Plan For Over 50

Is Funeral Insurance Worth It

Seniors Funeral Plans