All Categories

Featured

Table of Contents

It permits you to budget plan and strategy for the future. You can easily factor your life insurance coverage right into your budget plan due to the fact that the costs never change. You can prepare for the future equally as conveniently due to the fact that you know precisely just how much money your loved ones will get in case of your lack.

This is real for people who gave up smoking or that have a health and wellness condition that resolves. In these cases, you'll normally need to go via a new application procedure to get a much better price. If you still need coverage by the time your degree term life plan nears the expiry day, you have a couple of choices.

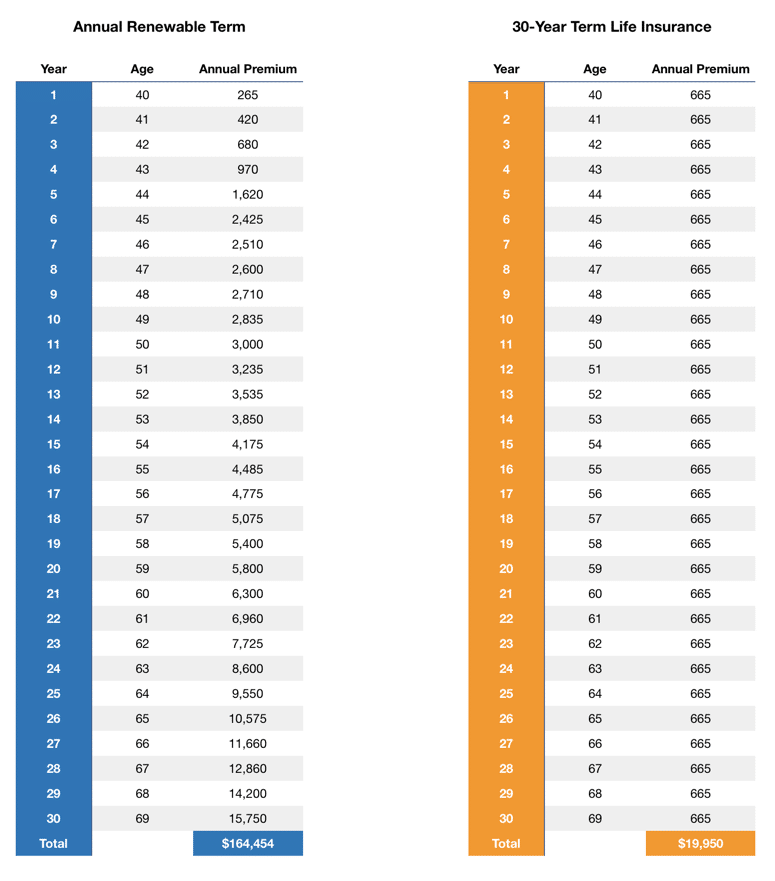

Many level term life insurance policy plans come with the alternative to restore insurance coverage on an annual basis after the first term ends. guaranteed issue term life insurance. The expense of your policy will certainly be based on your existing age and it'll enhance annually. This can be an excellent choice if you only require to extend your insurance coverage for a couple of years otherwise, it can get pricey quite rapidly

Level term life insurance policy is among the most inexpensive insurance coverage options on the market because it provides standard security in the kind of fatality advantage and only lasts for a set duration of time. At the end of the term, it expires. Whole life insurance policy, on the various other hand, is considerably much more costly than degree term life since it does not expire and comes with a money worth attribute.

Leading What Is Decreasing Term Life Insurance

Rates might differ by insurance company, term, protection quantity, wellness class, and state. Degree term is a terrific life insurance coverage alternative for the majority of individuals, however depending on your insurance coverage demands and personal situation, it might not be the best fit for you.

This can be a great option if you, for instance, have simply quit smoking cigarettes and require to wait 2 or three years to use for a level term policy and be qualified for a lower price.

Secure Which Of These Is Not An Advantage Of Term Life Insurance

, your death advantage payment will lower over time, but your repayments will certainly stay the very same. On the various other hand, you'll pay more in advance for much less coverage with a boosting term life plan than with a degree term life policy. If you're not certain which kind of plan is best for you, working with an independent broker can aid.

Once you've decided that degree term is ideal for you, the following step is to buy your policy. Right here's how to do it. Determine how much life insurance policy you need Your protection amount should supply for your family members's long-lasting monetary demands, including the loss of your income in the event of your fatality, as well as debts and everyday expenditures.

A degree costs term life insurance policy plan allows you stick to your budget while you aid secure your family members. Unlike some tipped price plans that enhances every year with your age, this kind of term plan provides prices that stay the same through you select, also as you grow older or your health and wellness changes.

Learn a lot more concerning the Life Insurance options offered to you as an AICPA member. ___ Aon Insurance Policy Providers is the trademark name for the broker agent and program administration operations of Affinity Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Coverage Solutions Inc.; in CA, Aon Affinity Insurance Services, Inc.

What Is Voluntary Term Life Insurance

The Strategy Agent of the AICPA Insurance Coverage Trust, Aon Insurance Policy Solutions, is not connected with Prudential. Team Insurance policy insurance coverage is released by The Prudential Insurance Policy Business of America, a Prudential Financial company, Newark, NJ. 1043476-00002-00.

Latest Posts

Best Funeral Plan For Over 50

Is Funeral Insurance Worth It

Seniors Funeral Plans