All Categories

Featured

Table of Contents

Mortgage life insurance provides near-universal insurance coverage with minimal underwriting. There is typically no medical checkup or blood example called for and can be a useful insurance coverage choice for any house owner with serious pre-existing clinical conditions which, would certainly stop them from purchasing standard life insurance policy. Other advantages consist of: With a home loan life insurance policy in area, heirs will not need to stress or wonder what might happen to the family members home.

With the home loan paid off, the household will always have an area to live, given they can afford the real estate tax and insurance coverage each year. group mortgage protection policy.

There are a couple of various types of mortgage protection insurance policy, these include:: as you pay more off your home mortgage, the quantity that the policy covers lowers according to the outstanding balance of your home mortgage. It is the most common and the least expensive form of mortgage protection - insurance for home loan compulsory.: the quantity insured and the premium you pay remains degree

This will certainly settle the home mortgage and any continuing to be equilibrium will certainly most likely to your estate.: if you want to, you can include serious disease cover to your home mortgage defense policy. This indicates your mortgage will be gotten rid of not just if you die, yet also if you are identified with a severe ailment that is covered by your policy.

Loss Of Job Insurance For Mortgage

In addition, if there is an equilibrium continuing to be after the mortgage is removed, this will certainly most likely to your estate. If you transform your home loan, there are a number of points to think about, depending on whether you are covering up or extending your home loan, switching, or paying the home mortgage off early. If you are topping up your mortgage, you require to ensure that your plan fulfills the brand-new worth of your mortgage.

Contrast the prices and benefits of both alternatives (mutual life mortgage). It might be less costly to maintain your initial home mortgage security policy and after that get a second policy for the top-up amount. Whether you are topping up your home mortgage or expanding the term and require to get a brand-new plan, you might find that your premium is greater than the last time you got cover

Mis Sold Mortgage Payment Protection Insurance

When switching your home mortgage, you can designate your home loan defense to the brand-new lending institution. The premium and degree of cover will be the very same as before if the quantity you borrow, and the term of your mortgage does not transform. If you have a plan with your loan provider's team scheme, your lending institution will certainly terminate the policy when you change your home mortgage.

There will not be an emergency where a big bill is due and no chance to pay it so soon after the fatality of an enjoyed one. You're giving comfort for your family members! In The golden state, mortgage protection insurance covers the whole superior equilibrium of your funding. The fatality benefit is an amount equivalent to the balance of your mortgage at the time of your death.

Mortgage Protection Service Center

It's important to understand that the survivor benefit is offered directly to your lender, not your loved ones. This guarantees that the continuing to be debt is paid completely and that your loved ones are spared the financial strain. Home loan protection insurance can also give momentary coverage if you become handicapped for a prolonged duration (generally six months to a year).

There are several advantages to obtaining a home loan security insurance coverage in California. A few of the top benefits include: Guaranteed approval: Also if you're in bad health or operate in a harmful career, there is ensured authorization with no medical examinations or lab tests. The exact same isn't true permanently insurance policy.

Handicap protection: As mentioned over, some MPI policies make a few mortgage repayments if you come to be impaired and can not bring in the very same revenue you were accustomed to. It is vital to keep in mind that MPI, PMI, and MIP are all different kinds of insurance policy. Home loan defense insurance (MPI) is created to repay a mortgage in case of your fatality.

Mortgage Payment Protection Insurance

You can also apply online in mins and have your policy in position within the same day. To learn more concerning obtaining MPI coverage for your mortgage, get in touch with Pronto Insurance today! Our well-informed representatives are below to respond to any concerns you might have and supply further aid.

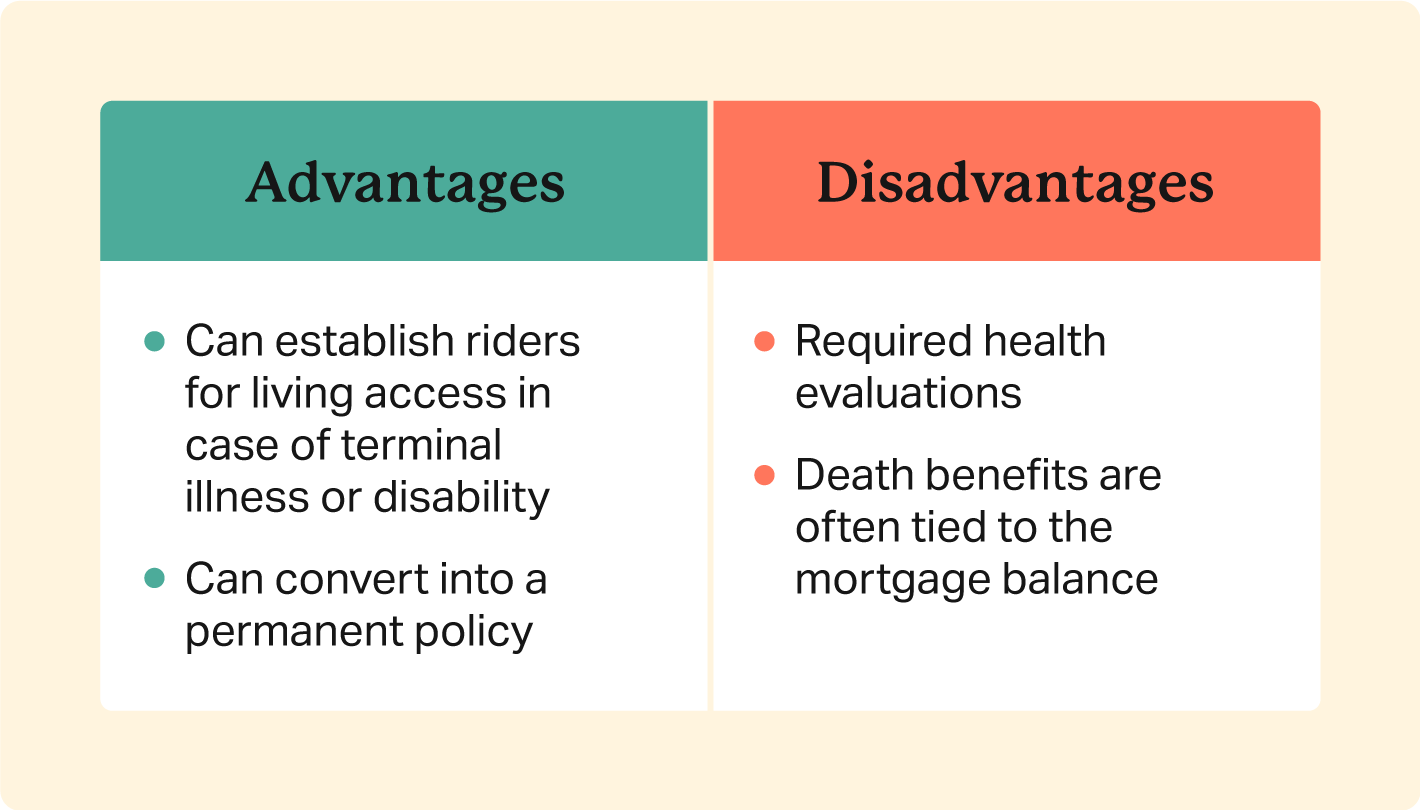

MPI provides a number of benefits, such as peace of mind and simplified credentials processes. The death advantage is directly paid to the loan provider, which restricts versatility - is mortgage insurance. Furthermore, the benefit amount lowers over time, and MPI can be a lot more pricey than common term life insurance policy plans.

Bank Loan Insurance Charges

Enter standard information regarding yourself and your home mortgage, and we'll compare prices from different insurance companies. We'll likewise show you just how much coverage you need to secure your mortgage.

The major advantage right here is clarity and self-confidence in your decision, knowing you have a strategy that fits your needs. As soon as you authorize the plan, we'll take care of all the documentation and arrangement, ensuring a smooth execution process. The favorable result is the comfort that comes with knowing your family members is shielded and your home is safe, no matter what happens.

Specialist Advice: Support from experienced experts in insurance policy and annuities. Hassle-Free Setup: We handle all the paperwork and implementation. Affordable Solutions: Locating the most effective protection at the most affordable possible cost.: MPI particularly covers your home loan, providing an extra layer of protection.: We function to locate one of the most cost-efficient remedies tailored to your spending plan.

They can offer details on the coverage and advantages that you have. Generally, a healthy and balanced person can expect to pay around $50 to $100 monthly for home mortgage life insurance. Nevertheless, it's recommended to obtain a customized mortgage life insurance quote to get a precise estimate based upon individual circumstances.

Latest Posts

Best Funeral Plan For Over 50

Is Funeral Insurance Worth It

Seniors Funeral Plans